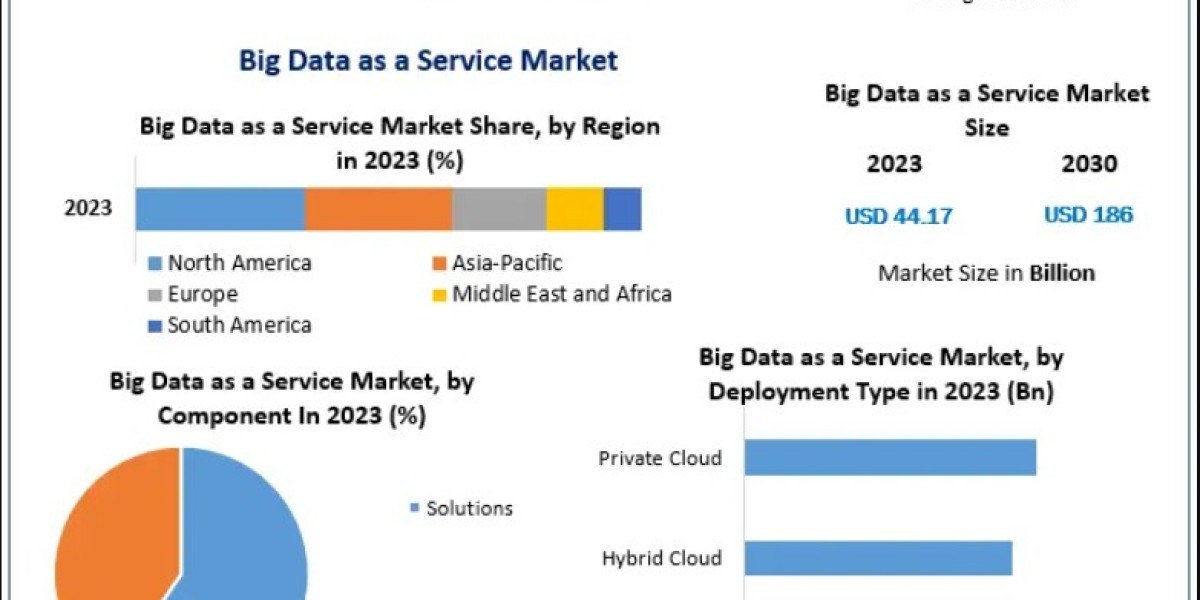

Big Data as a Service Market Expected to Reach USD 186 Billion by 2030 as Enterprises Accelerate Digital Intelligence

The Global Big Data as a Service (BDaaS) Market is entering a high-growth phase, projected to reach USD 186 billion by 2030 at a strong CAGR of 22.8%. As digital ecosystems expand, enterprises are moving rapidly toward cloud-based analytics platforms to derive meaningful insights from massive volumes of structured and unstructured data. This shift is redefining decision-making, customer engagement, and operational intelligence across all major industries.

The Rise of BDaaS: A New Era of Cloud-Powered Intelligence

Big Data and Cloud Computing—two transformative enterprise technologies—are converging to unlock unprecedented business value. Organizations are increasingly leveraging Big Data as a Service to simplify data storage, accelerate analytics, and extract competitive advantages across marketing, operations, risk management, and customer experience.

Massive data generation is the new normal in the digital enterprise ecosystem. Machine-generated logs, mobile interactions, social media content, and IoT devices now produce more than 1,000 exabytes of data each year, a number set to grow twentyfold over the next decade. BDaaS helps enterprises to analyze this data explosion without the need for heavy on-premise infrastructure or specialized in-house expertise.

While the potential of big data is immense, many companies still struggle to tap its value due to siloed systems, skill shortages, and challenges in scaling analytics. BDaaS bridges this gap by offering ready-to-use data management, analytics, and visualization capabilities through cloud-based delivery.

Access your free report sample — uncover the top-performing segments today:https://www.maximizemarketresearch.com/request-sample/59007/

Market Dynamics: What’s Fueling the Demand for BDaaS?

- Explosion of Unstructured Data

Digital communication—ranging from social media feeds to GPS logs and video content—continues to surge. Traditional tools fail to manage such diverse datasets, creating demand for scalable, cloud-native analytics platforms.

- Increasing Adoption of Data Science & Predictive Analytics

Enterprises across BFSI, healthcare, retail, and manufacturing are rapidly investing in predictive analytics, customer personalization, risk modeling, and operational optimization, driving BDaaS uptake.

- Cloud Maturity and Cost Efficiency

Public cloud adoption is accelerating due to its affordability and the elimination of heavy capital expenditure. Cloud providers now offer integrated, secure ecosystems for AI, ML, and big data applications.

- Shortage of Skilled Big Data Professionals

Despite rising analytics demand, many organizations struggle with talent availability. BDaaS allows them to bypass this challenge by relying on external platforms and expertise.

Challenges Persist

- Difficulty in defining business value

- Integration of multiple data systems

- Infrastructure complexity in large-scale deployments

According to industry surveys, 56% of technology leaders are still evaluating how to extract tangible ROI from big data initiatives.

Segmentation Analysis: Key Insights

By Component

- Solutions segment dominated with 61.43% share in 2023, driven by growing demand for tools that store, manage, and analyze massive datasets.

- Services segment continues to expand as enterprises seek consulting, integration, and managed analytics.

By Deployment

- Public Cloud holds the largest share (38.67%) due to scalability and lower cost.

- Private Cloud adoption is rising at a 23.54% CAGR, driven by enterprise-grade security.

- Hybrid Cloud offers the best of both worlds, enabling controlled data governance with public cloud flexibility.

By Organization Size

- Large enterprises lead adoption owing to high data volumes and rapid digitalization.

- SMEs are fast adopters too, using BDaaS to compete with data-driven giants.

By End User

Major industries transforming with BDaaS include:

- BFSI

- IT & Telecom

- Healthcare & Life Sciences

- eCommerce & Retail

- Manufacturing

- Media & Entertainment

Banks rely on BDaaS for fraud detection and customer segmentation, while healthcare organizations use it for clinical insights and medical research. Retailers depend heavily on real-time consumer analytics.

Access your free report sample — uncover the top-performing segments today:https://www.maximizemarketresearch.com/request-sample/59007/

Regional Outlook: North America Leads, Europe and APAC Gain Momentum

North America

With 38.76% market share in 2023, North America dominates due to:

- Presence of leading technology providers

- High digital maturity

- Strong adoption in government, BFSI, manufacturing, and IT sectors

The U.S. remains the powerhouse of BDaaS innovation.

Europe

Holding 27.85% share, Europe is witnessing rapid digital acceleration, particularly in:

- Germany

- UK

- France

AI, IoT, ML, and advanced analytics are increasingly embedded into enterprise operations.

Asia Pacific

APAC is emerging as a fast-growing hub due to:

- Expanding enterprise digitalization

- Major investments in smart manufacturing

- Adoption of cloud platforms in India, Japan, South Korea, and Southeast Asia

With rising data generation and analytics requirements, APAC offers massive future opportunities.

Competitive Landscape: Innovation and Strategic Expansion Shape the Market

The BDaaS market is highly competitive, with global players focusing on technological innovation, partnerships, and acquisitions. Key companies include:

- IBM

- Oracle

- Microsoft

- AWS

- SAP

- Teradata

- SAS

- Dell Technologies

- HPE

- Splunk

- Cloudera

- Salesforce

- Qubole

- GoodData

- Hitachi Vantara

- 1010data

- Guavus

- Accenture

- UST Global

- MapR Technologies

Notable Developments

- IBM’s USD 34B acquisition of Red Hat (2018) positioned it as a leading hybrid cloud provider.

- Oracle’s acquisition of DataScience.com (2018) strengthened its AI-embedded BDaaS offerings.

These strategic moves highlight the industry's intense push toward hybrid cloud analytics and integrated data science platforms.

Conclusion: BDaaS Is Becoming the Backbone of the Digital Enterprise

The Global Big Data as a Service Market is evolving rapidly as organizations seek scalable, cloud-native solutions to manage vast data quantities and unlock actionable insights. With digital transformation accelerating across industries, BDaaS will play a critical role in powering AI-driven systems, predictive modeling, automation, and real-time decision-making.

As enterprises prioritize intelligence-led growth, BDaaS is expected to become a foundational component of next-generation business ecosystems—driving innovation, reducing operational complexity, and creating new competitive frontiers.