Differences in between Triple Net and Gross leases and their impact on occupant expenses.

Strategies to efficiently work out Triple Net leases by managing costs.

Essentials of Gross leases, concentrating on expenditure stops and operating costs.

How working with a Real Tenant Rep ™ assists protect much better lease terms.

As an industrial occupant, you're no doubt acquainted with the 2 most typical kinds of leases: Triple Net and Gross. Naturally, when preparing to negotiate one should be well-informed concerning how the different types might implicate the overall expense of one's tenancy.

The different negotiating aspects can have influence over the total net worth of your lease, so check out on. Whether you need a refresher or just some something to chew on, you'll discover how to finest leverage the worth of your tenancy to the max degree.

Triple Net Leases

With triple net industrial leases (NNN), the renter is responsible for paying for all expenditures connected to their pro rata share of the residential or commercial property, consisting of residential or commercial property taxes, insurance coverage, and upkeep costs. Simply put, the property manager is just accountable for the structural elements of the building and the occupant is responsible for whatever else within their portion. As an outcome then, renters negotiate a lower base rent in exchange for handling these costs and paying running expense suppliers straight.

Negotiating Triple Net Leases

Negotiating a triple net lease needs careful consideration of the specific expenses that will be the renter's obligation. It is very important to identify the costs upfront and make sure that they are sensible, as unexpected costs can rapidly consume into an occupant's earnings.

Additionally, commercial occupants need to ensure that there are limitations to the amount of costs that they are responsible for which the stipulation specifies what the landlord's responsibility is to cover repair work and maintenance.

This is particularly important for older structures, which remain in turn, most likely to demand upkeep. If the burden is on you to cover those costs in a triple net lease, they can rapidly build up, becoming incredibly pricey. So, when negotiating, always remember to think about the overall potential worth of the lease beyond base lease (and how it may differ throughout lease types).

The other indicate consider is more modern-day updates to business expenses. Since there is a push to make business buildings carbon neutral, numerous proprietors will be anticipated to upgrade the source of power in their buildings. Obviously, converting to electric can become exceptionally costly. If you're a tenant in a building of this case, your role is to lay out which costs may be expected to fall under your spending plan.

-Darrel Wheeler of Moody's Analytics

Any capital investment or additions to the structure should remain in your property owner's budget plan. This is especially real if they will last longer than the length of your tenancy. Remember: They're upgrading their structure. Out-of-code structures will be far cheapened, so by contrast the market worth of their residential or commercial property raises with green standards. So, ensure that you don't get stuck with the bill.

Full Service/ Gross Leases

Gross leases, on the other hand, are leases in which the property owner is responsible for paying all expenditures related to the residential or commercial property. This includes residential or commercial property taxes, insurance coverage, and upkeep expenses. Tenants work out a greater base rent in exchange for not having to fret about these costs. The essential difference in settlement in between these leases depends on the business expenses.

Negotiating Gross Leases

Determining the rate of business expenses is mostly out of the proprietor's hands. Usually, the suppliers will set their particular price. As an outcome, there is likely very little negotiating you can do about those costs with your landrord. Similarly, if there are escalations to these expenses, you might not remain in a position to get out of paying them. If you remain in a full-service lease, your property manager will charge a greater base rent rate to cover increases that OpEx suppliers present. Landlords will typically pass-through OpEx escalations to renters.

One of the primary determinants for your OpEx budget in a gross lease is the amount your property owner accepts cover. With operating costs, particularly in multi-tenant buildings, property managers usually include the base year of OpEx in a full-service workplace lease. Their portion is referred to as the cost stop. All expenses beyond this stop are gone through to you, the renter. Learn more about How to Ensure Your OpEx Benefits your Budget

Tenants must be hyper-aware of how the expense stop is computed due to the fact that these base-year expenses are fixed throughout of the lease's term. You will be accountable for the operating expenditures above this base year expense stop. Your proprietor will preserve the original expense stop, whether prices stay the exact same or increase. As a result, the gross rental rate devoted to covering operating costs will stay the exact same. By doing so, they are safeguarding themselves from inflation while leaving you susceptible to it. In this case, your operating expenses are most likely to grow over your lease term.

If you are not cautious when negotiating your OpEx, you might be economically accountable for more than you haggled for. If you're preparing a brand-new lease or in a position to renegotiate, ensure that the following concerns are completely attended to:

What expenses are passed on to you, the occupant?

How are expenses determined?

What is your expense share?

What controls are on the costs; exist any caps?

When are expense boosts paid?

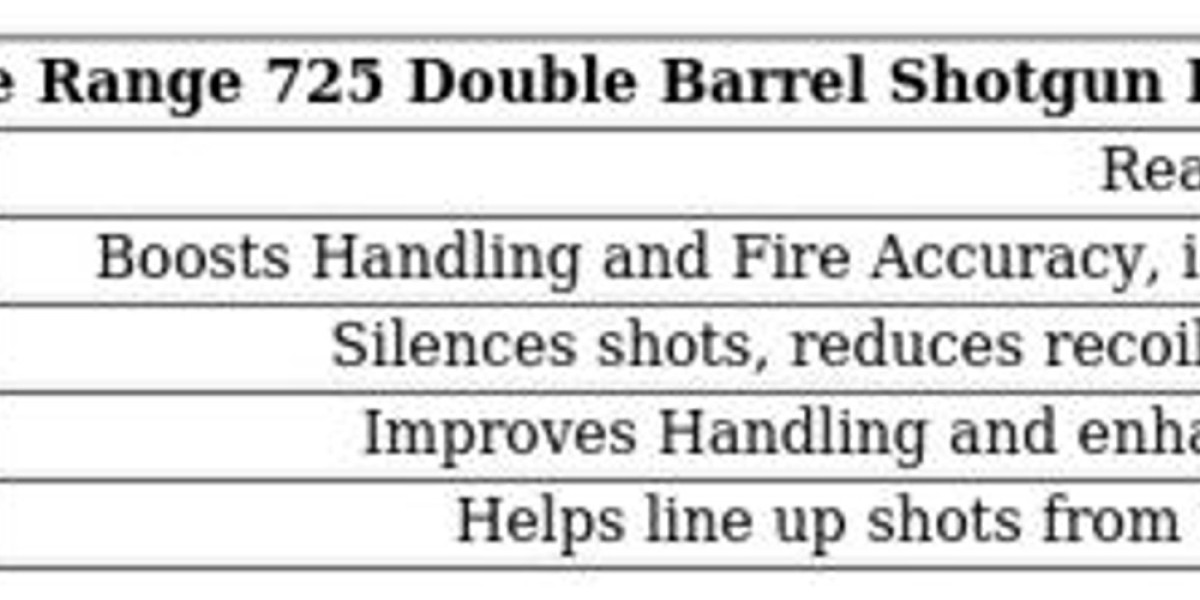

When working out a gross lease, the tenant agent ought to focus on negotiating a fair base rent that takes into account the property owner's expenditures. But at the end of the day, the total expense of triple net and complete leases should not vary excessive when everything is taken into account. Note the following mock cost delineations in between the kinds of leases for which the occupant is straight responsible.

Still a main point to think about with gross leases is that your proprietor will normally include a residential or commercial property management charge among the business expenses charges. What they charge you for residential or commercial property management is within their direct control. As an outcome, you have the possible to request a percentage cap to prevent excessive costs.

Typically, a residential or commercial property management fee will be around 3-5 percent of the lease. Don't permit the proprietor to pass on more than the common charges associated with residential or commercial property management. In a tenant-preferred lease, the residential or commercial property management cost would be closer to 3%. Accordingly, if you deal with a tenant rep that safeguards your interests alone, they will push for a similar, low rate.

Additionally, occupant agents should make certain that the lease includes specific arrangements that outline the property manager's obligations for keeping and fixing the residential or commercial property.

Negotiating with a True Tenant Rep ™

With a triple net lease, occupants must understand the particular costs they are accountable for and ensure that the stipulation defines the property manager's duty for repairs and upkeep. On the other hand, with a gross lease, renters must focus on working out a reasonable base lease that considers the property manager's expenses and take notice of the expense stop and residential or commercial property management fee. Negotiating a triple net workplace lease needs a more detailed analysis of the costs and responsibilities that will be borne by the occupant, while working out a gross lease needs a focus on working out a fair base rent that takes into consideration the proprietor's expenses.

Despite the lease type, it is essential for tenants to completely review and negotiate the lease contract to avoid unexpected expenditures that can affect their profits. Which is why occupants should never ever enter into conversations with their landord unprepared. The very best method to secure your interests in an industrial lease is by dealing with a Real Tenant Rep ™, an industrial real estate expert who only works for occupants.

At iOptimize Real estate ®, we have more than three decades of experience working out leases in the very best interests of our business clients. Our company believe in directing commercial occupants to the residential or commercial properties and features that fit their requirements best while getting them the finest deal on the marketplace. Part of this goal is by making the knowledge of True Tenant Reps ™ available to business occupants everywhere. Register for our blog site to discover how to stay on the top of your CRE game and keep up to date with the newest patterns and surefire techniques to improve your EBITDA.