In today’s monetary panorama, individuals typically discover themselves in want of fast cash for unexpected bills. Whether it's a medical emergency, automotive restore, or pressing invoice, getting access to funds may be essential. If you are you looking for more information on borrow money online instantly no credit check stop by our page. For these with poor credit historical past or no credit in any respect, conventional loan options is probably not accessible. This is where $400 loans with no credit check come into play. This report delves into the main points of these loans, together with their advantages, risks, application process, and alternate options.

What's a $four hundred Loan with No Credit Check?

A $400 loan with no credit check is a sort of quick-term, unsecured personal loan that enables borrowers to access $400 with out undergoing a credit score check. These loans are typically provided by different lenders, together with payday loan firms, on-line lenders, and credit unions. The approval process is often quick, often allowing borrowers to receive funds inside a day.

Advantages of $400 Loans with No Credit Check

- Quick Access to Money: Certainly one of the primary advantages of these loans is the speed at which funds will be accessed. Many lenders provide a streamlined software course of that may be completed online in minutes.

- No Credit Historical past Required: Because the name suggests, these loans do not require a credit score check, making them accessible to people with poor credit score scores or no credit history. This opens doorways for those who would possibly otherwise be denied by conventional banks.

- Versatile Use: Borrowers can use the funds for numerous purposes, including medical bills, automobile repairs, or everyday expenses. This flexibility is interesting to those going through unexpected prices.

- Simple Application Process: The appliance course of for these loans is often simple, requiring minimal documentation. Most lenders may only need proof of revenue, identification, and a checking account.

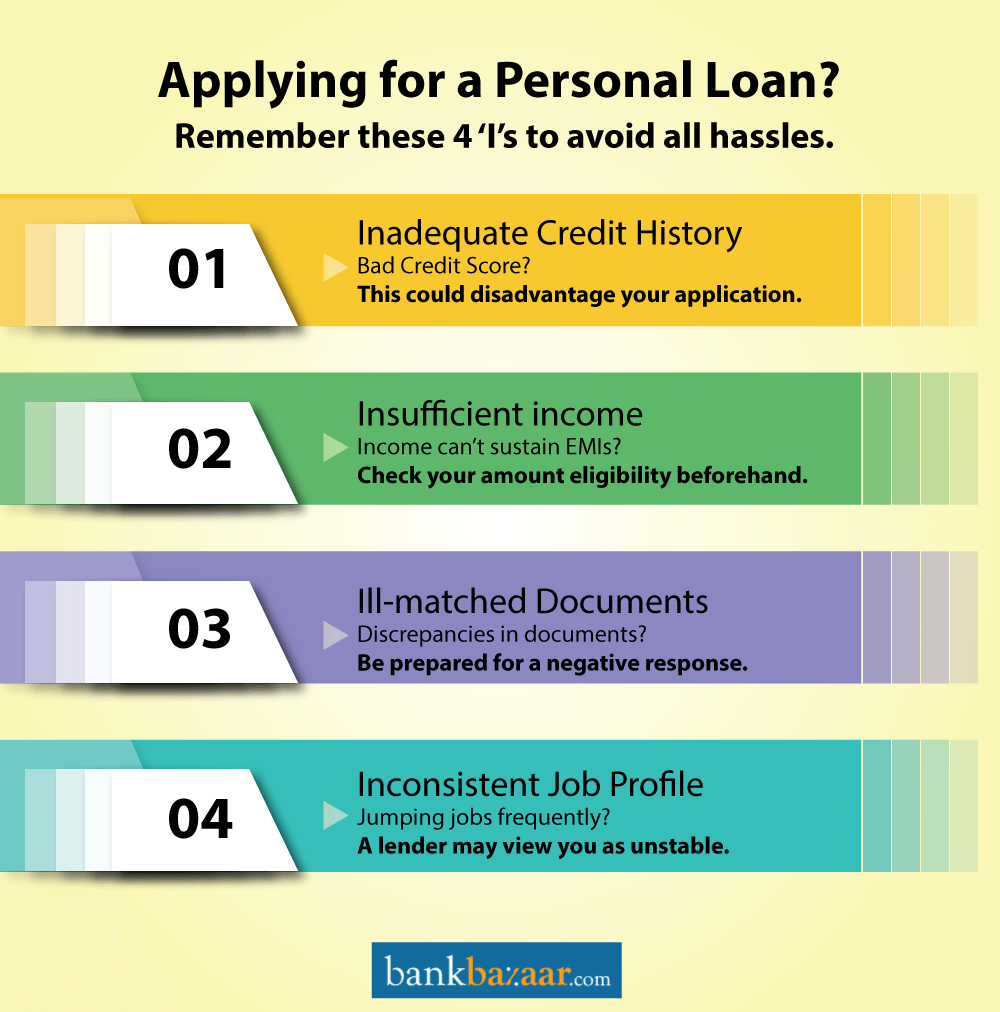

Dangers and Concerns

Whereas $400 loans with no credit check might be helpful, additionally they include significant risks that borrowers ought to remember of:

- Excessive-Curiosity Rates: These loans often carry excessive-interest charges in comparison with conventional loans. Borrowers might discover themselves in a cycle of debt if they're unable to repay the loan on time.

- Short Repayment Phrases: Many no credit check loans have quick repayment intervals, usually ranging from two weeks to a month. This could create financial pressure if borrowers are unable to repay the loan rapidly.

- Potential for Debt Cycle: Attributable to excessive prices and brief repayment phrases, borrowers might take out extra loans to pay off current ones, leading to a cycle of debt that can be exhausting to escape.

- Charges and Penalties: Lenders might cost numerous fees, including origination charges or late cost penalties, which might add to the overall price of the loan.

The applying Course of

Making use of for a $four hundred loan with no credit check sometimes entails the next steps:

- Research Lenders: Begin by researching numerous lenders that provide no credit check loans. Evaluate interest charges, fees, and phrases to search out one of the best option on your wants.

- Full the appliance: Most lenders present an internet utility kind. You will need to offer personal information, including your name, tackle, earnings, and checking account particulars.

- Submit Documentation: Some lenders might require proof of income, equivalent to pay stubs or bank statements. Guarantee you've gotten these paperwork able to expedite the method.

- Receive Approval: After submitting your software, the lender will assessment it and determine whether or not to approve your loan. This process can take simply a few minutes.

- Obtain Funds: If authorized, the lender will typically deposit the funds immediately into your checking account, typically within one business day.

Options to $400 Loans with No Credit Check

If you're hesitant about taking out a $400 loan with no credit check due to the associated risks, consider these options:

- Credit score Unions: Many credit unions provide small personal loans with decrease interest charges and extra favorable terms than payday lenders. If you're a member of a credit score union, inquire about their loan choices.

- Peer-to-Peer Lending: On-line platforms connect borrowers with particular person investors prepared to fund loans. These platforms usually consider elements past credit score scores, equivalent to revenue and employment historical past.

- Personal instant loans for bad credit no credit check from Conventional Lenders: Some banks and online lenders supply personal loans that consider different elements as an alternative of just credit score scores. If in case you have a gradual revenue, you may qualify for a loan with higher terms.

- Borrowing from Buddies or Family: If doable, consider asking mates or household for a loan. This selection may come with lower or no curiosity, and repayment terms will be more flexible.

- Payment Plans: If your financial want is related to a invoice or medical expense, inquire about cost plans with the service supplier. Many corporations offer versatile payment options that can ease financial stress.

Conclusion

$four hundred loans with no credit check can present fast monetary relief for those in need. Nevertheless, it is essential to weigh the benefits in opposition to the risks, together with excessive-interest rates and the potential for falling right into a debt cycle. Before making use of for such loans, consider researching numerous lenders, understanding the terms, and exploring various choices which will supply higher monetary outcomes. Always borrow responsibly and ensure that you have a plan in place for repayment to keep away from future financial strain.