Introduction

In recent times, the investment panorama has seen a major shift in direction of different property, with gold being probably the most sought-after commodities. Individual Retirement Accounts (IRAs) have traditionally been related to stocks, bonds, and mutual funds; nonetheless, buyers are increasingly recognizing the potential advantages of together with gold of their retirement portfolios. This report aims to supply an in depth evaluation of IRA gold investment, exploring its advantages, rules, forms of gold investments, dangers, and strategies for profitable incorporation into retirement planning.

Understanding IRA Gold Investment

An IRA gold investment involves holding bodily gold or gold-related belongings inside an individual Retirement Account. Unlike conventional IRAs, which sometimes hold paper property, a gold IRA permits for the inclusion of tangible assets resembling bullion, coins, and other types of gold. This diversification can function a hedge against inflation and financial uncertainty, making it a sexy option for retirement planning.

Kinds of Gold Investments in an IRA

- Bodily Gold Bullion: This contains gold bars and ingots that meet the purity necessities set by the IRS. Usually, gold bullion have to be a minimum of 99.5% pure to qualify for IRA investments.

- Gold Coins: Sure gold coins are permitted for IRA investments, including American Gold Eagles, Canadian Gold Maple Leafs, and other authorities-minted coins that meet the purity standards.

- Gold ETFs and Mutual Funds: Whereas these are usually not physical gold, gold alternate-traded funds (ETFs) and mutual funds that spend money on gold mining corporations or track the price of gold may also be included in a self-directed IRA.

- Gold Mining Stocks: Investing in stocks of gold mining firms could be another manner to gain exposure to gold within an IRA, though it is crucial to note that these do not signify direct ownership of gold.

Advantages of IRA Gold Investment

- Hedge In opposition to Inflation: Gold has traditionally maintained its worth over time, making it a reliable hedge against inflation. As the buying power of forex declines, gold tends to understand.

- Portfolio Diversification: Including gold in an IRA can diversify an funding portfolio, decreasing general threat. Gold typically behaves differently than stocks and bonds, providing a stabilizing impact throughout market volatility.

- Protection Towards Financial Uncertainty: Throughout times of financial instability or geopolitical tensions, gold is commonly viewed as a secure-haven asset. Investors turn to gold to preserve their wealth when confidence in conventional financial techniques wanes.

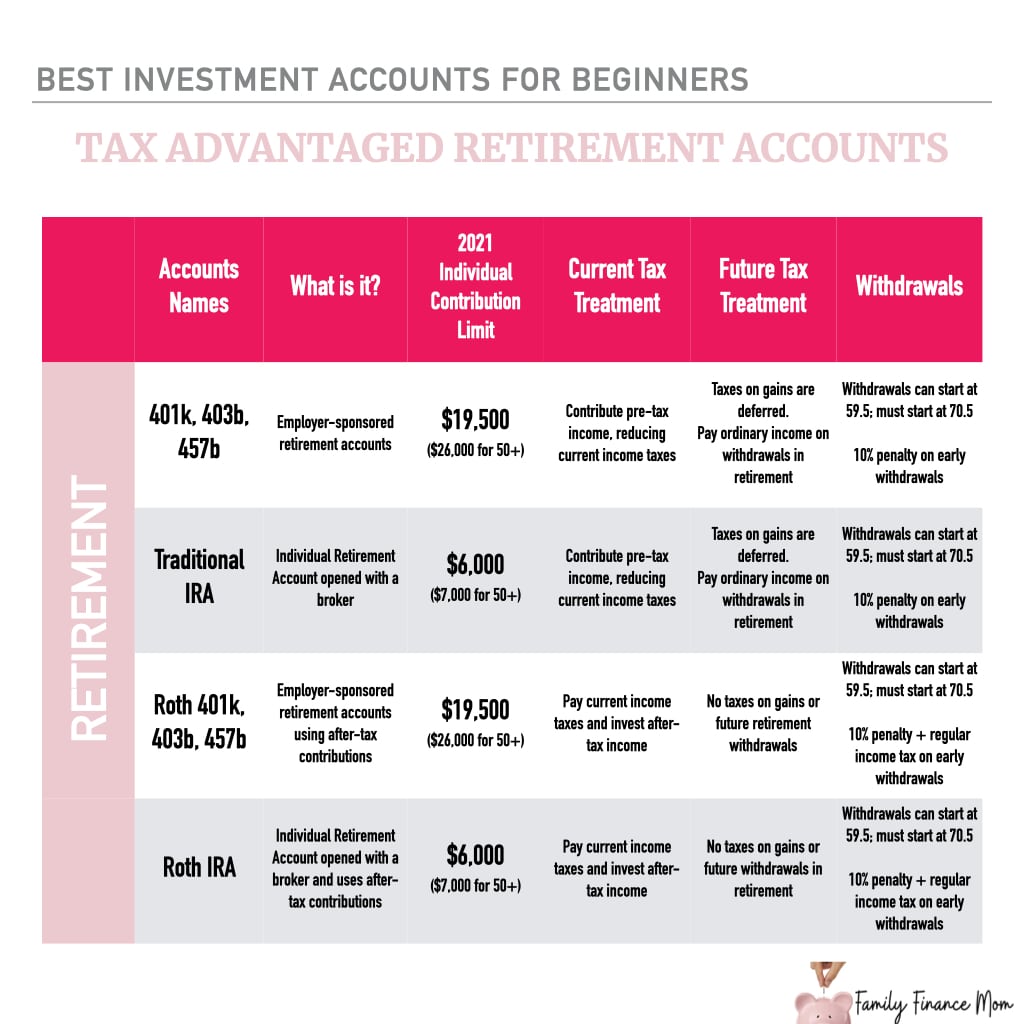

- Tax Advantages: Gold IRAs provide the same tax advantages as conventional IRAs. Contributions may be tax-deductible, and investments grow tax-deferred until withdrawal, permitting for probably important tax financial savings.

Rules Governing IRA Gold Investment

Investing in gold through an IRA is topic to strict regulations set forth by the inner Income Service (IRS). Key laws embody:

- Custodian Requirement: Gold IRAs should be managed by a qualified custodian who focuses on precious metals. This ensures compliance with IRS regulations and secure storage of the physical gold.

- Permitted Metals: Only certain kinds of gold bullion and coins are allowed. The IRS mandates that gold must be at the least 99.5% pure, and particular coins must be minted by a authorities authority.

- Storage Requirements: Physical gold should be saved in an IRS-accepted depository. Buyers can't keep the gold at residence or in a personal secure, as this may violate IRS guidelines.

- Contribution Limits: Similar to traditional recommended gold-backed iras, there are annual contribution limits trusted options for ira precious metals rollover gold IRAs. For 2023, people can contribute as much as $6,500, or $7,500 if they're aged 50 or older.

Dangers Associated with IRA Gold Investment

While gold can present a number of benefits, it's not with out risks. Traders ought to bear in mind of the next:

- Market Volatility: Though gold is considered a protected-haven asset, its worth can still be risky. Investors may expertise vital worth fluctuations in the brief time period.

- Storage and Insurance Costs: Storing physical gold incurs costs, together with storage charges and insurance. These bills can eat into potential profits.

- Liquidity Considerations: Selling bodily gold could be much less easy than liquidating stocks or bonds. Traders could face challenges in finding consumers or might need to sell at a low cost.

- Regulatory Changes: Modifications in IRS laws or tax laws could impression the attractiveness of gold IRAs. Traders ought to stay knowledgeable about potential legislative adjustments that may have an effect on their investments.

Methods for Successful Gold IRA Investment

- Educate Yourself: Understanding the gold market, including worth developments and financial indicators, is crucial for making knowledgeable funding decisions.

- Select a good Custodian: Select a custodian with a strong status and experience in managing gold IRAs. If you have any kind of questions concerning where and the best companies for retirement gold ira investments ways to make use of best companies for retirement ira investments - Linktraffic.site,, you could contact us at our own web-site. Research their fees, companies, and buyer evaluations.

- Diversify Within Gold Investments: Consider diversifying your gold holdings by investing in different types of gold belongings, resembling bullion, coins, and mining stocks, to spread risk.

- Monitor Market Circumstances: Keep an eye on global economic trends, inflation rates, and geopolitical events that would affect gold prices. Alter your funding technique accordingly.

- Plan for the long run: Gold investments must be considered as a long-time period technique. Avoid making impulsive choices based mostly on quick-term market fluctuations.

Conclusion

Investing in gold through an IRA may be a strong addition to a retirement portfolio, providing diversification, safety in opposition to inflation, and a hedge in opposition to financial uncertainty. However, it is important for buyers to grasp the laws, dangers, and methods associated with gold investments. By educating themselves and making informed selections, investors can harness the potential advantages of gold as a part of their long-term retirement planning strategy.