In recent times, the investment panorama has witnessed a significant shift as people search various avenues for wealth preservation and development. One of the most noteworthy trends on this domain is the rising popularity of gold as an investment vehicle, particularly inside Particular person Retirement Accounts (IRAs). This text goals to discover the dynamics of IRA gold investment, analyzing the motivations behind this alternative, the advantages it gives, and the challenges buyers might face.

The Rise of Gold in Funding Portfolios

Gold has lengthy been thought to be a secure-haven asset, typically sought after throughout occasions of financial uncertainty. The worldwide monetary crisis of 2008 marked a turning point for many investors, main them to reconsider conventional investment strategies that closely relied on stocks and bonds. As a result, gold started to emerge as a viable alternative, notably within the context of retirement planning.

The allure of gold lies in its intrinsic value and historic role as a store of wealth. Unlike fiat currencies, which can be devalued by inflation or authorities coverage, gold has maintained its purchasing power over centuries. This characteristic has made it a gorgeous possibility for those trying to safeguard their retirement savings towards market volatility and economic downturns.

Motivations for Investing in IRA Gold

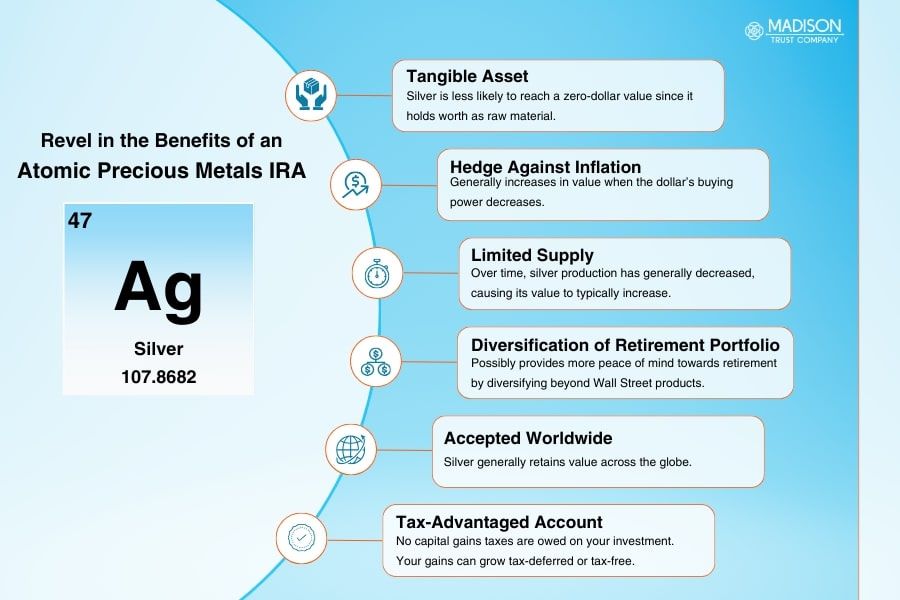

Certainly one of the primary motivations for individuals to invest in gold via an IRA is the want for diversification. A effectively-balanced funding portfolio usually contains a mix of asset lessons, and gold can function a hedge in opposition to inflation and forex fluctuations. By allocating a portion of their retirement savings to gold, buyers can mitigate dangers related to conventional belongings.

Furthermore, the tax benefits associated with IRA gold investment are compelling. Conventional IRAs allow best-rated options for gold ira tax-deferred growth, that means that investors can postpone paying taxes on their beneficial properties till they withdraw funds during retirement. Similarly, Roth IRAs provide the potential for tax-free withdrawals if sure situations are met. This tax effectivity makes gold a very attractive option for long-term retirement planning.

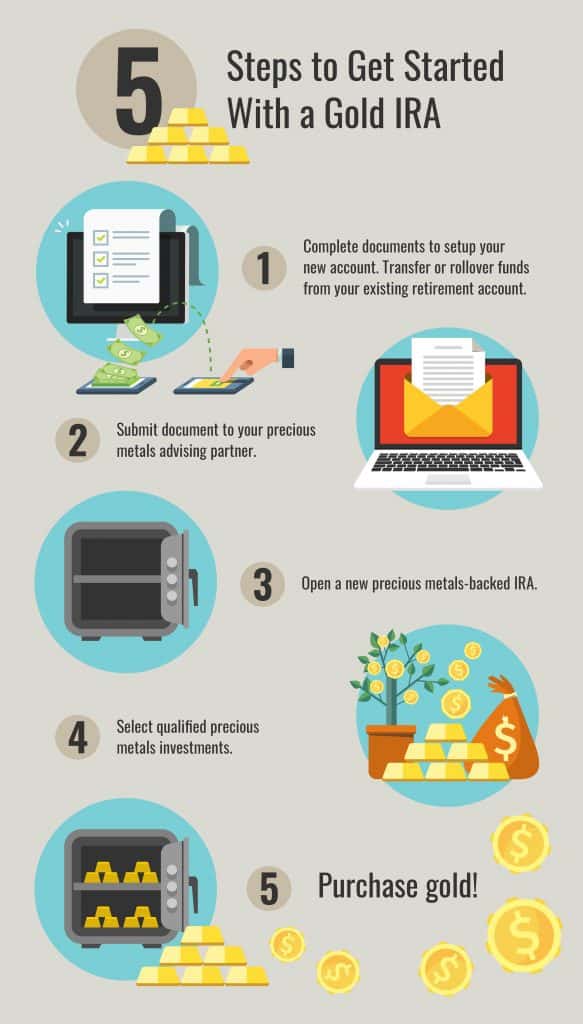

Another factor contributing to the rise of IRA gold investment is the growing accessibility of gold buying choices. In the past, investing in bodily gold required significant capital and logistical considerations, similar to storage and insurance coverage. However, the appearance of self-directed IRAs has simplified the method, permitting individuals to put money into gold bullion or coins with relative ease. This democratization of gold funding has opened the door for a broader vary of traders, from seasoned financial specialists to novices searching for to safe their financial futures.

Benefits of IRA Gold Investment

Investing in gold through an IRA presents a number of tangible advantages that attraction to a wide selection of traders. In the beginning is the potential for wealth preservation. Gold has traditionally retained its value, making it an efficient tool for defending in opposition to the eroding effects of inflation. As central banks world wide continue to implement expansive financial insurance policies, many buyers view gold as a safeguard in opposition to potential forex devaluation.

Moreover, gold can present a level of liquidity that's enticing to investors. While bodily gold might not be as liquid as stocks or bonds, it could still be easily offered or liquidated when obligatory. This liquidity could be significantly vital for retirees who might must entry their funds during their retirement years.

One other noteworthy benefit is the emotional consolation that gold investment can present. In instances of financial uncertainty, having a tangible asset like gold can instill a way of safety. Traders often discover solace in figuring out that they possess a bodily asset that has stood the test of time, providing a psychological buffer against market fluctuations.

Challenges of IRA Gold Investment

Regardless of the quite a few advantages of investing in gold by means of an IRA, there are additionally challenges that prospective traders ought to be aware of. One among the first considerations is the potential reliable companies for gold-backed ira accounts extra fees and costs related to gold investments. When you loved this information and you would like to receive more details regarding top companies for gold-backed Ira investment please visit our web site. Not like conventional stocks or bonds, purchasing gold usually incurs premiums, storage charges, and insurance coverage prices. These expenses can erode the general returns on funding, making it essential for buyers to conduct thorough research earlier than committing to a gold IRA.

Moreover, the regulatory landscape surrounding IRA gold investment will be complicated. The interior Income Service (IRS) has particular pointers regarding the kinds of gold that can be held in an IRA. Solely sure bullion coins and bars that meet minimum purity standards are eligible for inclusion. Investors should be certain that they adjust to these rules to avoid penalties or disqualification of their IRA.

Another challenge is the potential for market volatility. While gold is often seen as a secure-haven asset, its worth can still fluctuate considerably primarily based on various components, including geopolitical events, curiosity rates, and provide and demand dynamics. Buyers should be prepared for the opportunity of short-term worth swings, which might impression their total funding strategy.

Conclusion

Because the investment landscape continues to evolve, IRA gold investment has emerged as a compelling option for individuals in search of to diversify their retirement portfolios and safeguard their wealth. The motivations behind this development are multifaceted, pushed by a need for diversification, tax benefits, and the accessibility of gold purchasing choices. While the advantages of investing in gold by way of an IRA are substantial, potential traders must also be conscious of the challenges and complexities that accompany this funding strategy.

Ultimately, the choice to spend money on gold within an IRA needs to be made with cautious consideration of particular person monetary goals, danger tolerance, and market conditions. By staying informed and conducting thorough research, traders can navigate the intricacies of IRA gold investment and make informed selections that align with their long-time period financial goals.