Gold bullion coins have lengthy been a symbol of wealth, stability, and funding alternative. As tangible property, they provide a unique mix of intrinsic worth and aesthetic appeal that attracts collectors, investors, and lovers alike. This observational analysis article delves into the world of gold bullion coins for sale, exploring their traits, market traits, and the motivations behind their purchase.

Gold bullion coins are usually made from at least 91.67% pure gold, which is the standard for most fashionable bullion coins. Probably the most well-known examples embrace the American Gold Eagle, Canadian Gold Maple Leaf, and the South African Krugerrand. Each of these coins not only carries its weight in gold but additionally options distinctive designs that reflect the culture and heritage of the issuing country. As an example, the Gold Maple Leaf showcases the iconic Canadian maple leaf, while the American Gold Eagle features a rendition of Lady Liberty, symbolizing freedom and democracy.

Lately, the marketplace for gold bullion coins has skilled fluctuations, pushed by numerous financial factors. Observational studies performed at native coin outlets, on-line marketplaces, and valuable steel sellers reveal that shopper interest tends to spike during durations of economic uncertainty. For example, throughout the COVID-19 pandemic, many individuals sought refuge in tangible property as inventory markets plummeted and inflation concerns grew. This phenomenon was evident within the increased foot visitors noticed in coin retailers and a surge in online gross sales of bullion coins.

One notable development within the gold bullion coin market is the rising reputation of fractional coins. These smaller denominations, reminiscent of 1/10 oz and 1/four oz coins, cater to a broader viewers, together with novice traders who may be hesitant to spend invest money in gold online on a full ounce of gold. Observations point out that fractional coins are often marketed as accessible entry factors into the world of valuable metals, permitting individuals to diversify their portfolios without committing a considerable amount of capital. Moreover, these smaller coins often retain the next premium over spot gold costs compared to their full-ounce counterparts, making them a horny possibility for those trying to capitalize on brief-time period market movements.

One other fascinating aspect of gold bullion coins is their dual appeal as each funding vehicles and collectible gadgets. Many collectors are drawn to the historic significance of certain coins, such because the American buy gold online bar Eagle, which has been minted since 1986. Observational analysis at coin shows and auctions reveals that collectors typically attend these events not only to purchase or sell coins but also to engage in discussions about rarity, grading, and market traits. The social aspect of coin amassing adds an additional layer of enjoyment, fostering a sense of community among enthusiasts.

The grading of gold bullion coins plays an important role in determining their market value. Coins are graded on a scale from 1 to 70, with larger grades indicating higher situation and fewer imperfections. Observations of grading practices reveal a big impact on pricing; for instance, a coin graded as "MS-70" (perfect condition) can command a premium of several hundred dollars over a coin graded as "MS-69." This discrepancy highlights the importance of condition and authenticity in the gold bullion market, prompting patrons to seek reputable sellers and certification services to ensure their investments are sound.

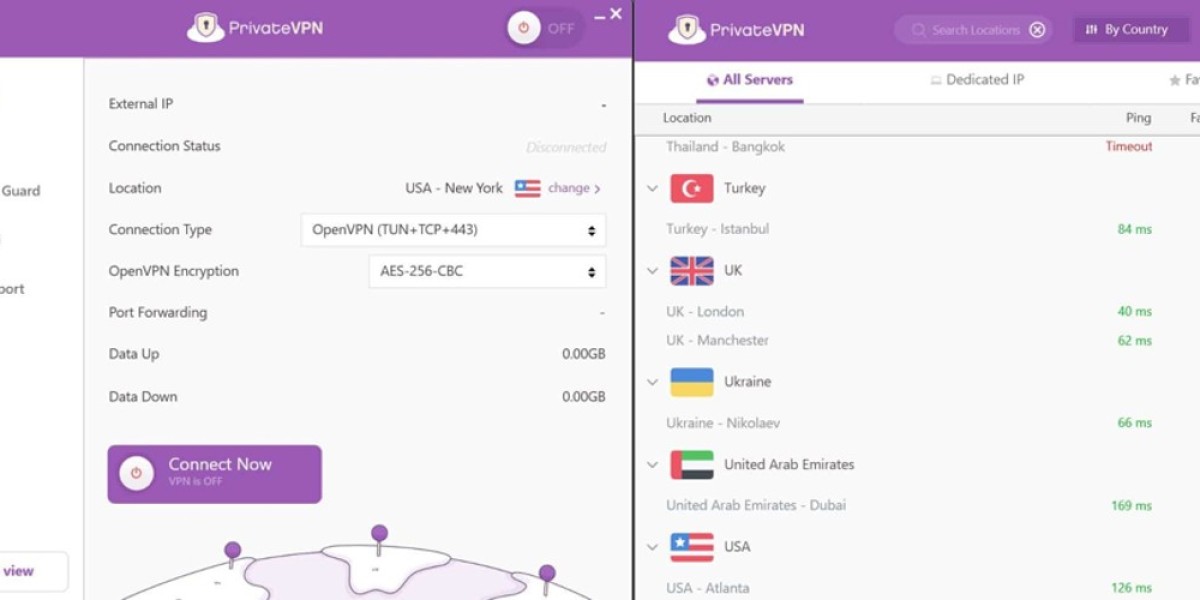

The rise of digital platforms has transformed the way individuals purchase and sell gold bullion coins. Online marketplaces equivalent to eBay, APMEX, and JM Bullion have made it simpler for shoppers to access a large variety of coins from the consolation of their properties. Observational analysis signifies that consumers appreciate the comfort of on-line purchasing, in addition to the flexibility to match costs and browse evaluations before making a purchase order. Nevertheless, this shift additionally raises issues in regards to the potential for counterfeit coins and the importance of verifying the credibility of sellers.

In addition to particular person traders, institutional patrons have also entered the gold bullion coin market. Observations suggest that central banks and enormous financial institutions are more and more including gold to their reserves as a hedge in opposition to inflation and currency fluctuations. This institutional demand can significantly influence market prices, as seen in recent times when central banks all over the world ramped up their gold purchases. The interplay between particular person and institutional shopping for patterns creates a dynamic market surroundings, where supply and demand factors regularly form the landscape.

The motivations behind buying gold bullion coins range widely amongst people. For some, the first goal is wealth preservation, while others view gold as a speculative investment. Observational research point out that many buyers are motivated by a need to diversify their monetary portfolios, notably in occasions of financial instability. The allure of gold as a "secure haven" asset often drives people to allocate a portion of their wealth to bullion coins, viewing them as a hedge in opposition to potential market downturns.

Moreover, the emotional connection to gold cannot be overlooked. Many consumers express a way of pride and satisfaction in owning tangible property, particularly these with historic significance. Observations reveal that the act of holding a gold coin can evoke emotions of safety and stability, reinforcing the notion that gold just isn't merely a financial investment but also an emblem of enduring worth.

In conclusion, the marketplace for gold bullion coins is a multifaceted panorama shaped by financial, cultural, and emotional factors. Observational analysis highlights the numerous motivations behind purchases, the impact of market traits, and the importance of authenticity and situation in figuring out worth. As people proceed to seek refuge in tangible belongings, the allure of gold bullion coins stays strong, ensuring their place within the annals of funding historical past. Whether considered as a retailer of value, a collectible, or a hedge in opposition to uncertainty, gold bullion coins proceed to captivate the interest of patrons all over the world, making them a big player within the realm of treasured metals.