In immediately's financial landscape, 15000 personal loan bad credit loans have turn into a vital resource for people in search of quick access to funds, whether or not for emergencies, debt consolidation, or unexpected expenses. Nonetheless, for those with bad credit, securing a loan can be a daunting process, especially with no cosigner. This article explores the choices available for individuals with poor credit score histories, the challenges they face, and suggestions for improving their chances of approval.

Understanding Dangerous Credit score

Bad credit score sometimes refers to a credit score score under 580, in response to FICO standards. This score can end result from various components, together with late funds, high credit score utilization, defaults, or bankruptcies. Individuals with dangerous credit score may find it tough to safe loans from traditional lenders, comparable to banks and credit score unions, as these establishments typically have strict lending criteria. In consequence, many flip to various lending options that cater specifically to these with poor credit score histories.

The Rise of other Lenders

Lately, alternative lenders have emerged as a viable choice for individuals with dangerous credit. These lenders include on-line platforms, peer-to-peer lending websites, and specialized monetary institutions that focus on offering loans to high-risk borrowers. In contrast to conventional banks, various lenders usually make use of extra versatile underwriting standards, considering components beyond credit scores, such as revenue, employment stability, and overall monetary habits.

Types of Personal Loans Accessible

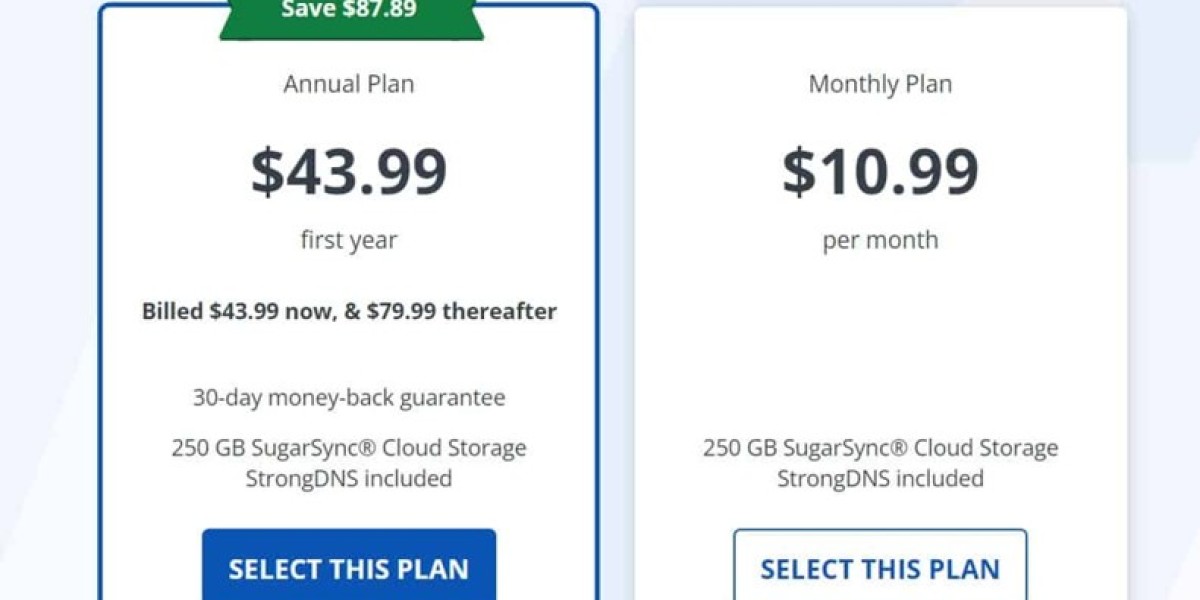

- On-line Personal Loans: Many online lenders provide personal loans particularly designed for individuals with unhealthy credit score. These loans typically include increased curiosity rates, but they supply quicker access to funds and a more streamlined utility process. For those who have almost any queries regarding where by and how to use personal loans for bad credit pre approval (learn more), you are able to e-mail us at our web-site. Borrowers can typically obtain approval inside minutes and funds within days.

- Peer-to-Peer Lending: Peer-to-peer (P2P) lending platforms connect borrowers with particular person investors keen to fund their loans. These platforms typically have less stringent credit score requirements, making them a lovely choice for those with unhealthy credit score. Nevertheless, interest rates should still be higher due to the increased danger for lenders.

- Credit Unions: Some credit unions supply personal loans to members with unhealthy credit. While credit unions typically have lower interest charges than alternative lenders, membership may be required, and the applying course of can range by establishment.

- Secured Personal Loans: Secured loans require borrowers to offer collateral, equivalent to a vehicle or financial savings account, to safe the loan. This reduces the lender's danger and should result in lower interest rates. Nonetheless, borrowers must be cautious, as failure to repay the loan may end result in the loss of the collateral.

Challenges Confronted by Borrowers with Dangerous Credit score

Whereas there are choices out there for obtaining personal loans without a cosigner, borrowers with dangerous credit still encounter a number of challenges:

- Increased Curiosity Rates: Lenders understand borrowers with bad credit as higher threat, resulting in elevated curiosity rates. This may significantly enhance the price of borrowing, making it important for borrowers to rigorously assess their capacity to repay the loan.

- Restricted Borrowing Quantities: Many various lenders impose caps on the amount that may be borrowed by people with bad credit. This could limit the monetary relief available to those looking for larger sums for vital expenses.

- Shorter Loan Phrases: Loans for individuals with dangerous credit score often include shorter repayment terms, which can result in greater monthly funds. Borrowers should ensure that they can manage these payments within their budget.

- Potential for Scams: The financial vulnerability of individuals with unhealthy credit could make them targets for predatory lenders. It's crucial for borrowers to research lenders totally, searching for reviews and checking for proper licensing to keep away from scams.

Tips for Bettering Chances of Approval

- Examine Your Credit score Report: Earlier than making use of for a loan, borrowers should review their credit experiences for errors or inaccuracies. Disputing incorrect info will help enhance their credit score score.

- Exhibit Stable Revenue: Lenders typically search for proof of stable revenue. Providing documentation, akin to pay stubs or tax returns, can strengthen an software.

- Cut back Debt-to-Income Ratio: A decrease debt-to-revenue ratio can enhance a borrower's attraction to lenders. Paying down existing debts or growing earnings may also help achieve this.

- Consider a Secured Loan: If potential, borrowers may need to explore secured loans, as these might supply higher terms and decrease curiosity charges.

- Store Round: Borrowers ought to evaluate provides from multiple lenders to search out the very best terms. On-line comparability tools can simplify this course of.

- Build Relationships with Native Lenders: Establishing a relationship with local banks or credit score unions can enhance the chance of securing a loan. Some lenders could also be more prepared to work with individuals they know, even with unhealthy credit.

Conclusion

Navigating the world of personal loans with bad credit score can be challenging, especially with out a cosigner. Nonetheless, alternative lenders have created opportunities for people in search of monetary assistance. By understanding the out there choices and taking proactive steps to enhance their creditworthiness, borrowers can enhance their chances of securing a personal loan that meets their needs. Because the lending panorama continues to evolve, those with dangerous credit score can find pathways to financial stability and empowerment, ensuring that they don't seem to be left behind in a world where access to credit score is more and more important.