UK Automotive Market Outlook 2023-2029: Navigating Change and Driving Growth

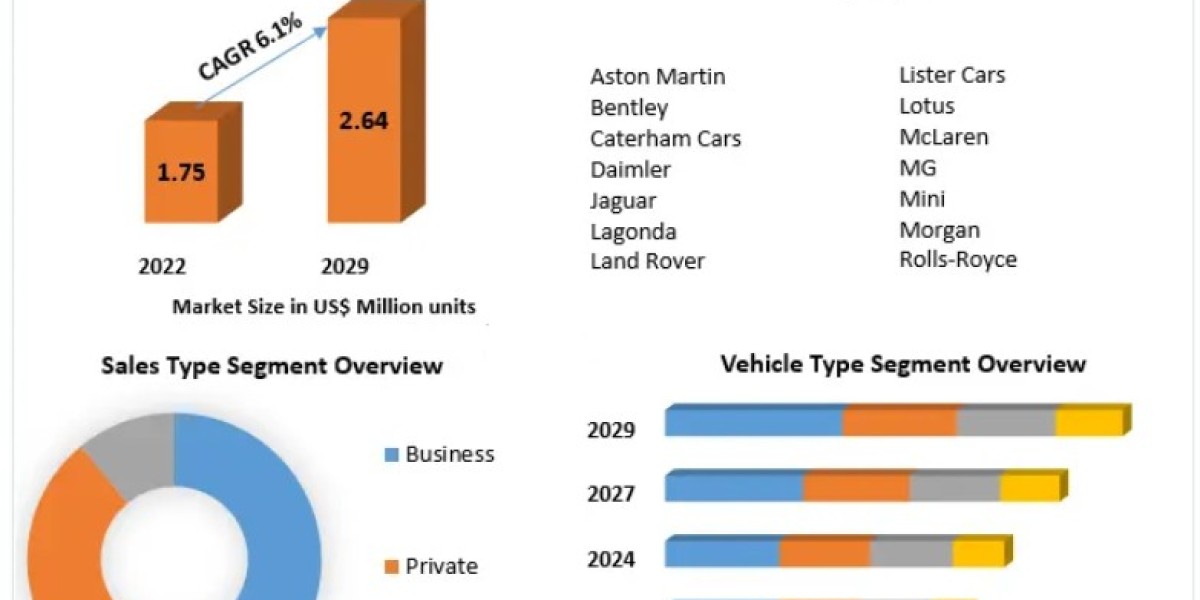

The UK Automotive Market recorded sales of 1.75 million units in 2022 and is projected to grow at a CAGR of 6.1%, reaching approximately 2.64 million units by 2029. Despite recent challenges, including the impact of COVID-19 and the BREXIT transition, the UK automotive sector is adapting to a new era of digitalization, electrification, and changing consumer preferences.

Market Overview

The UK automotive industry has faced unprecedented challenges in recent years. Supply chain disruptions exposed the sector’s reliance on European and global partners, while economic uncertainty and sustainability pressures impacted production and sales. Consumer confidence took a hit, prompting dealerships to explore digital-first strategies and virtual car buying experiences, fundamentally reshaping the market.

Government initiatives aimed at achieving Net Zero emissions by 2030 are reshaping the sector, particularly the move away from Internal Combustion Engine (ICE) vehicles. The UK has set one of the most ambitious targets for phasing out ICE passenger cars, placing pressure on automakers to ramp up production of electric vehicles (EVs) and hybrid vehicles. However, battery production capacity in the UK remains limited, with only 12 GWh projected by 2025, far behind Germany (164 GWh) and the United States (91 GWh).

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/86645/

Economic Significance

The automotive industry contributes approximately £15 billion in GVA to the UK economy, with production and exports supporting regional economies beyond London and the South East. Over 80% of cars and 60% of commercial vehicles produced in the UK are exported, reaching over 150 global markets. Europe remains the dominant export destination, followed by North America and Asia, highlighting the strategic importance of trade relationships for the UK automotive sector.

Market Trends

The UK vehicle market has shown resilience in recovering from the pandemic-induced slump. While Q2 2020 marked record low sales due to lockdowns, the market began rebounding in subsequent quarters. Historical trends show that the light vehicle market peaked at 3.06 million units in 2016, before declining in the aftermath of BREXIT and global economic uncertainties.

Consumer preferences are shifting toward zero-emission vehicles, with battery electric vehicle (BEV) production increasing by 53% in November 2021, reaching a new high of 10,359 units. British automakers, including Nissan, MINI, and the London Electric Vehicle Company, produced over 60,000 zero-emission vehicles in 2021, marking a critical step toward sustainable mobility.

Market Segmentation

By Vehicle Type:

- Passenger Cars: Dominating with a 60% market share, driven by strong sales of brands like Volkswagen and Ford.

- Commercial Vehicles: Moderate growth potential, aligned with fleet and logistics demand.

- Electric Vehicles (EVs): Rapidly expanding, with increasing production of BEVs and hybrid vehicles.

By Sales Type:

- Fleet: Leading segment with 53.3% market share, encompassing company fleets, dealer demonstrators, and leased vehicles.

- Private: Accounts for 44.1% of sales, reflecting individual consumer purchases.

- Business: Smaller segment at 2.6%, covering specialized corporate or institutional purchases.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/86645/

Competitive Landscape

The UK automotive market is home to several iconic brands, including:

- Luxury and Performance: Aston Martin, Bentley, Rolls-Royce, McLaren, Lotus

- Mainstream Passenger Vehicles: Jaguar, Land Rover, MG, Mini

- Specialty Manufacturers: Caterham Cars, Lister Cars, Morgan, Daimler, Lagonda

Market Dynamics: Brand rankings shifted in 2021, with Volkswagen retaining leadership, Audi and BMW seeing moderate growth, and Hyundai experiencing a remarkable 46.7% increase in sales, reflecting changing consumer preferences and brand appeal. Popular models included the Opel Corsa, Tesla Model 3, and Ford Focus, showcasing both traditional and electric vehicle demand.

Challenges and Opportunities

Challenges:

- Limited domestic battery production capacity

- High production costs for EVs and hybrids

- Supply chain vulnerabilities post-BREXIT

- Competition from European and Asian manufacturers

Opportunities:

- Growing EV and hybrid adoption supported by government incentives

- Expansion of digital-first and online vehicle sales channels

- Development of sustainable mobility solutions and zero-emission vehicles

- Strategic collaborations with global automotive suppliers to strengthen supply chains

Conclusion

The UK Automotive Market is at a pivotal moment, balancing recovery from economic disruption with the drive toward electrification and sustainability. While challenges such as supply chain resilience, battery production, and market competitiveness remain, the shift toward digital sales, fleet modernization, and zero-emission vehicles presents substantial growth opportunities. With proactive investments and policy support, the UK automotive industry is poised to strengthen its global standing while leading the transition toward cleaner, smarter, and more connected vehicles.