What is a Credit Balance?

A credit balance in medical billing occurs when a patient or insurance company pays more than the amount owed for healthcare services. This results in a negative balance on the patient's account and must be reviewed and resolved to maintain financial accuracy and regulatory compliance.

Step-by-Step Credit Balance Process

1. Credit Balance Identification

Credit balances are identified through:

Patient account audits

AR aging reports

Payment posting reviews

Monthly or quarterly financial reconciliations

Early identification helps prevent compliance risks and revenue inaccuracies.

2. Credit Balance Analysis

Once identified, each credit balance is reviewed to determine the root cause, such as:

Insurance overpayment

Duplicate payments

Incorrect charge entry

Contractual adjustment errors

Patient overpayments

Proper analysis ensures the correct resolution path.

3. Verification & Documentation

The billing team verifies:

Original charges

EOB/ERA details

Patient payment history

Insurance contracts

All findings are documented to support audits and payment communication.

4. Pay or Patient Resolution

Based on the analysis:

Insurance overpayments are refunded to the payer

Patient overpayments are refunded or applied to future balances (with patient consent)

Timely refunds are critical to meet compliance requirements.

5. Adjustment Posting

Correct financial adjustments are posted in the billing system to:

Clear the credit balance

Reflect accurate revenue

Maintain clean AR accounts

This step ensures correct accounting records.

6. Quality Check & Compliance Review

Before closure:

Accounts are reviewed for accuracy

Compliance guidelines are checked

Refund documentation is validated

This minimizes audit risks and errors.

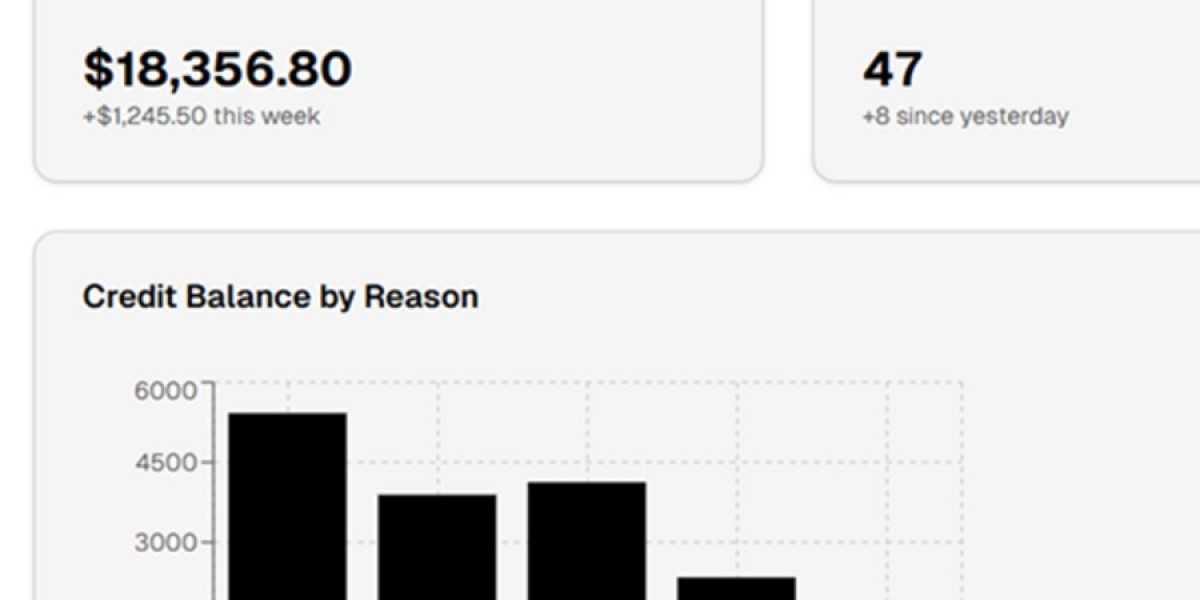

7. Reporting & Monitoring

Regular reporting includes:

Credit balance trends

Root cause analysis

Prevention strategies

Ongoing monitoring helps reduce future credit balance occurrences.

Why Credit Balance Management is Important

Prevents regulatory penalties

Maintains accurate financial records

Improves patient satisfaction

Improves overall revenue cycle efficiency

Conclusion

The credit balance process in medical billing is a vital component of revenue cycle management. A structured and compliant approach ensures accurate refunds, clean AR, and financial transparency. Proper credit balance handling protects both healthcare providers and patients while supporting long-term revenue integrity.